Find out how much you will have to pay for the Municipal Plusvalía in Fuerteventura and answer your questions about this municipal tax on the island.

The Municipal Plusvalía is how the Tax on the Increase in Value of Urban Land is known, one of the taxes that come into play when selling a home and that taxes the increase in value of urban land at the time it is transferred.

Until recently, no one could get rid of paying the Municipal Capital Gain when selling a property. What’s more, even if the sale produced patrimonial losses, the Municipal Plusvalía always came out to pay. It was from 2017 when the debate began around the constitutionality of this tax, precisely in response to the obligation to pay for a capital gain that, in many cases, was not occurring.

To end the debate, the Council of Ministers approved by Royal Decree Law on November 8, 2021 the new doctrine that regulates the Municipal Capital Gain from then on.

Do you want to know how all this affects the Municipal Capital Gain in Fuerteventura? Below we answer the 5 most common questions that usually arise around this tax. However, if you have any questions about this or any other tax related to the sale of a property in Fuerteventura, do not hesitate to contact one of our expert real estate advisors.

1. How is the Plusvalía calculated in Fuerteventura?

Since the Royal Decree Law of November 8, 2021, taxpayers will be able to choose between two different methods when calculating the Municipal Capital Gain in Fuerteventura:

- Real Capital Gain: takes into account the real capital gain experienced with the sale, that is, the difference between the acquisition price and the sale price to obtain the Taxable Base of the Tax, a value on which the corresponding Tax Rate established is applied. for each Town Hall.

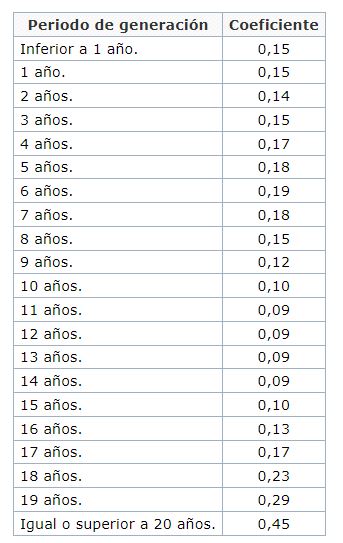

- Objective Method: takes into account a series of maximum coefficients updated annually through the General State Budgets. These coefficients will be applied to the cadastral value of the land based on the years elapsed between the acquisition and transfer of the home, resulting in the Taxable Base of the tax, a value on which the corresponding Tax Rate established by each must be applied. City hall.

Maximum amounts of the coefficients to be applied in the Impossible Base for Municipal Capital Gains in 2023.

2. How much do you have to pay for the Plusvalía in Fuerteventura?

The Plusvalía is a municipal tax, so you must consult the specific regulations of each Town Hall to find out how much you have to pay for the Municipal Plusvalía in Fuerteventura depending on each municipality.

The Town Halls will be able to adapt the Plusvalía to the reality of their municipalities in two different ways:

- Reducing the maximum coefficients stipulated by the Government for the calculation of the Municipal Capital Gain by up to 15% using the objective method.

- Establishing your own Tax Rate. This percentage can never be higher than 30%.

Municipal Capital Gains in La Oliva.

For example, to calculate the Municipal Capital Gain in La Oliva, a Tax Rate of 30% must be applied to the Taxable Base of the Tax, as stated in the La Oliva City Council regulations.

Municipal Capital Gains in Puerto del Rosario

On the contrary, to calculate the Municipal Capital Gain in Puerto del Rosario, a Tax Rate must be applied to the Taxable Base of the Tax that will vary depending on the years in which we have been in possession of the home, as stipulated in the tax itself. Regulations of the City Council of Puerto del Rosario.

- From 0 to 5 years: Tax rate of 25%.

- From 5 to 10 years: Tax rate of 22%.

- From 10 to 15 years: Tax rate of 20%.

- From 15 to 20 years: Tax rate of 19%.

As you can see, the price that will have to be paid for the Municipal Plusvalía in Fuerteventura will depend on the municipality in which the transaction is carried out. In other words, not all municipalities pay the same amount of Capital Gains when selling a home.

3. Who has to pay it?

Another aspect that usually raises doubts about this tax is the one referring to who has to pay this tax in each type of operation. To answer this question, we will review each type of real estate transfer in which the Municipal Capital Gain in Fuerteventura comes into play:

- Sale: the seller will be in charge of paying the Municipal Capital Gains.

- Inheritances: the heir will be in charge of paying the Municipal Capital Gains.

- Donations: the beneficiary of the donation will be in charge of paying the Municipal Capital Gains.

4. Who is exempt from paying the Plusvalía?

Responding to the question of who is exempt from paying the Municipal Capital Gain, we will go on to name some scenarios in which the payment of this tax is not mandatory:

- If the land has not experienced an increase in value: that is, when the price for which we are going to sell the house is lower than the price for which we acquired it at the time.

- When the transmission occurs between spouses.

- In sales of properties considered historical-cultural heritage: as long as their owners prove that they have taken responsibility for the works necessary for the conservation or improvement of the property.

- In transfers of properties belonging to state or charitable entities: that is, real estate owned by the State, the autonomous communities, charitable institutions or the Town Halls themselves.

5. What term is there to pay the amount?

The term to pay the Municipal Plusvalía will depend on the type of operation through which the property is transferred. For example, for sales or donation operations, the term to pay the Municipal Capital Gain will be 30 business days from the date on which the transmission occurs. On the contrary, in cases of inheritance, the term to pay the Municipal Capital Gain will be 6 months from the date of death, extendable for another 6 months.

Remember that if you have questions about this or any other tax that affects the sale of real estate in Fuerteventura, you can contact one of our real estate experts.

Esta información está disponible en / Post available in:

Français (French)

Español (Spanish)